Blackstone Mortgage Trust

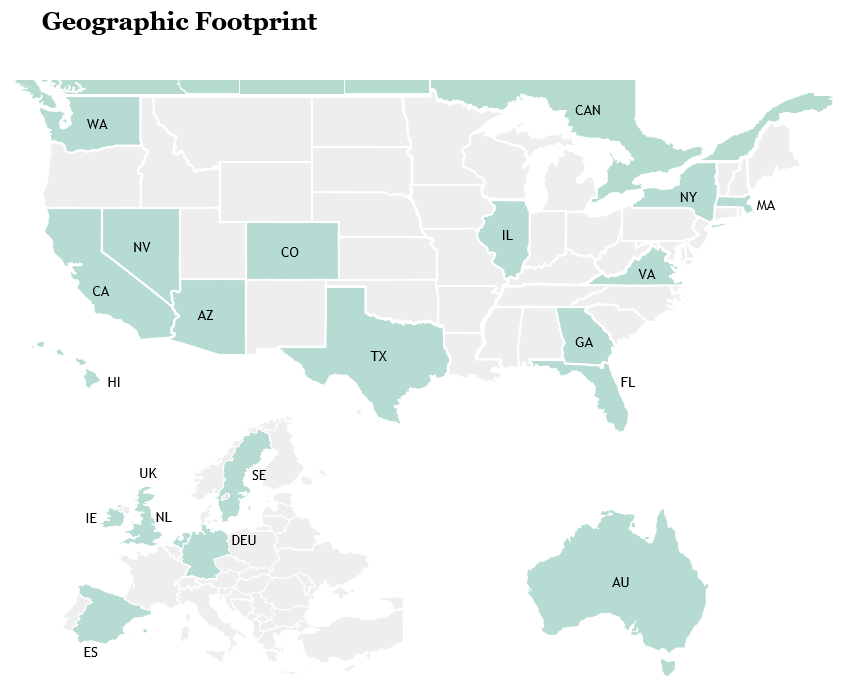

Blackstone Mortgage Trust (NYSE: BXMT) is a real estate finance company that originates senior loans collateralized by commercial real estate in North America, Europe and Australia.

Blackstone Affiliation

Our manager’s global presence and dynamic capabilities enable us to identify opportunities with conviction and partner with leading sponsors and financial institutions.

Floating Rate Senior Lending

Our mortgage loan portfolio is well positioned for yield and value preservation in various rate and credit environments.

Financing Advantage

Our large scale, high quality business drives efficiently priced and well structured financing with an emphasis on long term stability.

Blackstone Mortgage Trust Reports Third-Quarter 2025 Results

BXMT is sponsored by the largest owner of commercial real estate globally

Blackstone is the largest alternative asset manager

$1.2T

assets under management, including $320B in our Real Estate business

Blackstone Real Estate’s portfolio

$611B

in global value

Note: All figures as of September 30, 2025 unless otherwise indicated.

Our Portfolio

Our $16.8 billion portfolio is predominantly composed of loans on major market assets with top sponsors and is well diversified across asset classes and geographies.

Overview

$16.8

BILLION SENIOR LOAN PORTFOLIO

137

LOANS

64%

W.A. Origination LTV

As of September 30, 2025. States comprising less than 1% of total loan portfolio are excluded.

Sample Transactions

New Multifamily Development

Brooklyn, NY

$500 million whole loan secured by a newly developed multifamily property in Brooklyn, NY. The waterfront building is highly-amenitized and well-located, with 30% of the apartments designed as affordable.

Beachfront Hotel

Huntington Beach, CA

$156 million floating rate, first mortgage loan secured by a newly-built beachfront hotel located in Huntington Beach, CA. The property is anchored by an irreplaceable location, generating robust transient and group demand.

Our Manager is part of Blackstone’s leading real estate platform, which has $320 billion of investor capital under management.

Loan Parameters

Primarily First

Mortgage

Collateral

$50mm+

Loan Size

75%

Last Dollar LTV

+250bps

and up

Pricing

Executive and Other Senior Officers

Tim Johnson

Chief Executive Officer and Senior Managing Director

Timothy Johnson is the Chief Executive Officer of Blackstone Mortgage Trust (NYSE: BXMT), a publicly-traded commercial mortgage REIT managed by Blackstone. Mr. Johnson is also the Global Head of Blackstone Real Estate Debt Strategies (“BREDS”) and is responsible for overseeing Blackstone’s commercial and residential real estate debt investment strategies. Mr. Johnson is also a member of the firm’s real estate investment committee.

Prior to joining Blackstone in 2011, Mr. Johnson was a co-founder of BroadPeak Funding, a boutique commercial real estate finance company based in Los Angeles. Prior to founding BroadPeak, Mr. Johnson was a Vice President in the Lehman Brothers Global Commercial Real Estate Group where he worked from 2002-2008.

Mr. Johnson received a BA in Mathematics from the College of the Holy Cross where he graduated cum laude.

Austin Peña

President and Managing Director

Austin Peña is President of Blackstone Mortgage Trust (NYSE:BXMT), a publicly-traded commercial mortgage REIT managed by Blackstone. Mr. Peña is responsible for BXMT’s investment, capital allocation and balance sheet strategy.

Prior to joining Blackstone in 2013, Mr. Peña worked at Barclays in the Real Estate Investment Banking Group, where he was involved in advising REITs and other real estate companies on mergers, acquisitions, restructurings and capital markets transactions. Mr. Peña previously held a similar role at Lehman Brothers.

Mr. Peña graduated magna cum laude with a BS in Economics from the University of Pennsylvania.

Anthony Marone, Jr

Chief Financial Officer and Managing Director

Anthony F. Marone, Jr. is a Managing Director in the Real Estate group and the Global Head of Real Estate Finance, based in New York. Mr. Marone also serves as the Chief Financial Officer of Blackstone Real Estate Income Trust (BREIT), a non-traded public REIT, and Blackstone Mortgage Trust (NYSE: BXMT).

Prior to joining Blackstone in 2012, Mr. Marone was a Vice President and Controller at Capital Trust, Inc., the predecessor business to BXMT. Previously, Mr. Marone worked in the Real Estate Assurance practice of PricewaterhouseCoopers LLP.

Mr. Marone received a B.S. and an MBA from Rutgers University and is a Certified Public Accountant and Chartered Global Management Accountant.

Marcin Urbaszek

Deputy Chief Financial Officer and Managing Director

Marcin Urbaszek serves as our Deputy Chief Financial Officer and Principal Accounting Officer. He is also a Managing Director in Blackstone Real Estate Debt Strategies. Before joining Blackstone in 2024, he served as the Chief Financial Officer, Treasurer and Head of Investor Relations of Granite Point Mortgage Trust Inc. (NYSE: GPMT) since its inception in 2017. Mr. Urbaszek has over 20 years of corporate finance and strategic advisory experience, across roles in investment banking, capital markets and equity research, with over 15 years dedicated to financial institutions. Mr. Urbaszek received a B.B.A. in Finance from Zicklin School of Business, Bernard M. Baruch College, CUNY, and is a CFA® charterholder.

Scott Mathias

Chief Compliance Officer and Secretary

Scott Mathias is a Managing Director and Co-Chief Compliance Officer of Blackstone Real Estate and serves as the Chief Compliance Officer and Secretary for Blackstone Mortgage Trust (BXMT).

Prior to joining Blackstone in 2016, Mr. Mathias was an Associate in the Private Funds group at Simpson Thacher & Bartlett LLP where he advised and represented some of the largest and most well-known sponsors of private equity and hedge funds.

Mr. Mathias received a BBA in Marketing and Psychology from the University of Wisconsin-Madison and a JD from New York University School of Law, where he graduated cum laude.

Robert Sitman

Head of Asset Management and Managing Director

Robert Sitman is a Managing Director and Global Head of Asset Management in Blackstone Real Estate Debt Strategies (“BREDS”), based in New York.

Since joining Blackstone in 2014, Mr. Sitman has been involved in originating, structuring, executing and asset managing real estate debt investments across all asset types and geographies.

Prior to joining Blackstone, Mr. Sitman was an associate in the Real Estate group of Fried, Frank, Harris, Shriver & Jacobson LLP, where he represented owners, developers, investors and lenders in commercial real estate transactions.

Mr. Sitman received a B.A. in Political Science from the University of Michigan and a J.D. from Brooklyn Law School, where he graduated cum laude.

Timothy Hayes

Vice President, Shareholder Relations

Timothy Hayes is a Principal in Blackstone Real Estate Debt Strategies (“BREDS”) on the Strategy & Management team, based in New York. Mr. Hayes is focused on shareholder relations for BXMT and BREDS strategy.

Prior to joining Blackstone, Mr. Hayes worked as a sell-side equity analyst at BTIG and B. Riley FBR, covering the real estate and mortgage finance sectors. He previously was an analyst at Edmunds White Partners, a small-cap investment advisor.

Mr. Hayes received his Bachelor of Science in Business Administration (BSBA) from the Robins School of Business at the University of Richmond.

Investment Committee

Kathleen McCarthy

BX Global Co-Head of Real Estate and Senior Managing Director

Kathleen McCarthy is the Global Co-Head of Blackstone Real Estate. Blackstone is the largest owner of commercial real estate globally and an industry leader in opportunistic, core plus and debt investing across North America, Europe and Asia. Ms. McCarthy focuses on driving performance and growth for Blackstone’s Real Estate business.

Ms. McCarthy previously served as Global Chief Operating Officer of Blackstone Real Estate. Before joining Blackstone in 2010, Ms. McCarthy worked at Goldman Sachs, where she focused on investments for the Real Estate Principal Investment Area. Ms. McCarthy began her career at Goldman Sachs in the Mergers & Acquisitions Group.

Ms. McCarthy received a BA from Yale University. Ms. McCarthy is currently serving a three-year term as Chair of the Real Estate Roundtable, the industry’s top federal advocacy organization. She also serves on the boards of City Harvest and the Blackstone Charitable Foundation, and is the President of the Board of Trustees of The Nightingale-Bamford School.

Nadeem Meghji

BX Global Co-Head of Real Estate and Senior Managing Director

Nadeem Meghji is the Global Co-Head of Blackstone Real Estate. Blackstone is the largest owner of commercial real estate globally and an industry leader in opportunistic, core plus and debt investing across North America, Europe and Asia.

Mr. Meghji previously served as Head of Real Estate Americas and has played a leadership role in Blackstone Real Estate’s investment activity in the region. Mr. Meghji joined Blackstone in 2008.

Mr. Meghji received a BS in Electrical Engineering from Columbia University, where he graduated summa cum laude. He received a JD from Harvard Law School and an MBA from Harvard Business School. Mr. Meghji was named a World Economic Forum Young Global Leader in 2018 and serves as a board member for the Lupus Research Alliance.

Kenneth Caplan

BX Global Co-Chief Investment Officer and Senior Managing Director

Kenneth A. Caplan is the Global Co-Chief Investment Officer of Blackstone. As Co-CIO, he works in conjunction with business unit CIOs and Group Heads to provide additional firm-level investment oversight, primarily across Real Estate and Credit & Insurance (BXCI).

Mr. Caplan previously served as Global Co-Head of Blackstone Real Estate. Blackstone is the largest owner of commercial real estate and an industry leader in opportunistic, core plus and debt investing across North America, Europe and Asia.

Prior to becoming Global Co-Head of Blackstone Real Estate, Mr. Caplan served as Global Chief Investment Officer of Blackstone Real Estate and Head of Real Estate Europe. Since joining the firm in 1997, Mr. Caplan has been involved in over $100 billion of real estate acquisitions and initiatives in the United States, Europe and Asia. These include major acquisitions such as Equity Office Properties, Hilton Hotels, Logicor and GE Real Estate.

Before joining Blackstone, he was at Lazard Freres & Co. in the real estate investment banking group. Mr. Caplan received an AB in Economics from Harvard College, where he graduated magna cum laude, was elected to Phi Beta Kappa and was a John Harvard Scholar. He currently serves on the Board of Trustees of Prep for Prep.

Giovanni Cutaia

BX Global Chief Operating Officer of Real Estate and Senior Managing Director

Giovanni Cutaia is the Global Chief Operating Officer of Real Estate and Global Head of Real Estate Asset Management.

Prior to joining Blackstone in 2014, Mr. Cutaia was at Lone Star Funds where he was a Senior Managing Director and Co-Head of Commercial Real Estate Investments Americas. Prior to Lone Star, Mr. Cutaia spent over 12 years at Goldman Sachs in its Real Estate Principal Investments Area as a Managing Director in its New York and London offices.

Mr. Cutaia received a BA from Colgate University and an MBA from the Tuck School of Business at Dartmouth College.

Katie Keenan

BX Global Head of Core + Real Estate and Senior Managing Director

Katie Keenan is the Global Head of Core + Real Estate and Chief Executive Officer of Blackstone Real Estate Income Trust (“BREIT”). She previously served as the Global Co-Chief Investment Officer of Blackstone Real Estate Debt Strategies (“BREDS”) and the Chief Executive Officer, President and a Director of Blackstone Mortgage Trust (NYSE:BXMT), a publicly-traded commercial mortgage REIT managed by Blackstone.

Prior to joining Blackstone in 2012, Ms. Keenan held positions at G2 Investment Group, Lubert-Adler Real Estate Funds and in the Real Estate Investment Banking Group at Lehman Brothers.

Ms. Keenan graduated cum laude with an AB in History from Harvard College. She sits on the Board of Directors of Getting Out and Staying Out and the Advisory Board of Governors of NAREIT, and is a member of WX New York Women Executives in Real Estate.

Rob Harper

Head of BX Real Estate US Asset Management and Senior Managing Director

Rob Harper is the Head of Real Estate Asset Management Americas. Since joining Blackstone in 2002, Mr. Harper has been involved in analyzing Blackstone’s real estate equity and debt investments in all property types. Mr. Harper has previously worked for Blackstone in Los Angeles and London, where he served as Head of Europe for the Blackstone Real Estate Debt Strategies business. Mr. Harper currently serves as a board member for the Global Heritage Fund and the McIntire School of Commerce Foundation Board at the University of Virginia. His prior board memberships include Invitation Homes, Park Hotels & Resorts and Extended Stay America.

Prior to joining Blackstone, Mr. Harper worked for Morgan Stanley’s real estate private equity group in Los Angeles and San Francisco.

Mr. Harper received a BS from the McIntire School of Commerce at the University of Virginia.

Jacob Werner

BX Co-Head of Americas Acquisitions and Senior Managing Director

Jacob Werner is Co-Head of Americas Acquisitions for Blackstone Real Estate and a member of Blackstone Real Estate’s global investment committee.

Since joining Blackstone in 2005, Mr. Werner has been involved in more than $100 billion of real estate investments across several property sectors and has worked on various transactions, including the acquisition of BioMed Realty, American Campus Communities, Pure Industrial, Home Partners of America, and Education Realty Trust.

Mr. Werner received a BS from the McIntire School of Commerce at the University of Virginia where he graduated with distinction and currently serves on the board of Hudson River Park Friends.

Michael Wiebolt

Global Chief Investment Officer of BREDS and Senior Managing Director

Mike Wiebolt is the Global Chief Investment Officer of Blackstone Real Estate Debt Strategies (“BREDS”), based in New York. BREDS invests in public and private real estate credit globally on behalf of a variety of institutional, public and insurance capital vehicles.

Prior to joining Blackstone, he worked at Goldman Sachs, where he was most recently responsible for trading high yield CMBS and CRE CDOs.

Mr. Wiebolt holds a BA in History from Carleton College, where he graduated magna cum laude and was elected to Phi Beta Kappa. Mr. Wiebolt also received an MBA from the Columbia Graduate School of Business. Mr. Wiebolt serves on the Board of Trustees at Carleton College and the Associates Council of Prep for Prep.

Brian Kim

Global Chief Operating Officer of BREDS and Senior Managing Director

Brian Kim is the Global Chief Operating Officer of Blackstone Real Estate Debt Strategies (“BREDS”) based in New York and serves as Chief Executive Officer of Blackstone Private Real Estate Credit & Income Fund (BREC).

Since joining Blackstone in 2008, Mr. Kim has played a key role in a number of Blackstone’s investments including the take private and subsequent sale of Strategic Hotels & Resorts, the acquisition of Peter Cooper Village / Stuyvesant Town and the creation of BRE Select Hotels Corp., Blackstone’s select service hotel platform. Mr. Kim also previously served as the Gobal Chief Operating Officer of Blackstone’s Core + real estate business.

Prior to joining Blackstone, Mr. Kim worked at Apollo Real Estate Advisors, Max Capital Management Corp. and Credit Suisse First Boston.

Mr. Kim previously served as a board member and the Head of Acquisitions and Capital Markets of Blackstone Real Estate Income Trust, a board member of CorePoint Lodging Inc. and a board member and Chief Financial Officer of BRE Select Hotels Corp. Mr. Kim received an AB in Biology from Harvard College where he graduated with honors.

Senior Investment Professionals

Ana Gonzalez-Iglesias

Global Head of Capital Markets and Managing Director

Ana Gonzalez-Iglesias is a Managing Director and Global Head of Capital Markets in Blackstone Real Estate Debt Strategies (“BREDS”), based in London. Ms. Gonzalez-Iglesias is responsible for overseeing financing strategy and execution across vehicles in the US, Europe and Australia.

Prior to joining Blackstone, Ms. Gonzalez-Iglesias was an Executive Director at Morgan Stanley focusing primarily on commercial real estate loan originations. Prior to that, she focused on Debt Capital Markets transactions across sectors.

Ms. Gonzalez-Iglesias received a Bachelor’s Degree in Business Administration and Management, and a Bachelor’s Degree in Law from CUNEF (Colegio Universitario de Estudios Financieros).

David Gorleku

Head of Originations Europe and Managing Director

David Gorleku is a Managing Director and Head of Europe for Blackstone Real Estate Debt Strategies (“BREDS”), based in London. Mr. Gorleku is responsible for the BREDS investment activities across all asset types and geographies throughout Europe.

Before joining Blackstone in 2020, Mr. Gorleku held roles at London-based Actis Capital in the real estate group as well as at TPG Real Estate Finance and at Goldman Sachs in New York where he focused on real estate debt and equity investments across the United States.

Mr. Gorleku received a BA from Williams College in Massachusetts and an MBA from the University of Chicago Booth School of Business.

Michael Henry

Head of Asset Management US and Managing Director

Michael Henry is a Managing Director and Head of Asset Management Americas in Blackstone Real Estate Debt Strategies (“BREDS”), based in New York.

Since joining Blackstone in 2014, Mr. Henry has been involved in originating, underwriting, structuring and asset managing real estate debt investments across various asset types and geographies.

Prior to joining Blackstone, Mr. Henry was an Associate at Five Mile Capital Partners on the investments team handling the evaluation and execution of a variety of debt and equity transactions. Prior to Five Mile, Mr. Henry was an Analyst in Cushman & Wakefield’s Equity, Debt & Structured Finance group.

Mr. Henry received a BA in Economics from Boston College.

Clarke Hitch

Managing Director

Clarke Hitch is a Managing Director in Blackstone Real Estate Debt Strategies (“BREDS”), on the Strategy & Management team, based in New York. Mr. Hitch leads investment strategy and new initiatives across institutional vehicles including the BREDS Drawdown Funds and Institutional SMAs.

Prior to joining Blackstone in 2013, Mr. Hitch worked at Morgan Stanley in the Commercial Real Estate Lending Group.

Mr. Hitch graduated from Duke University with an AB in Public Policy.

Tom Jack

Managing Director

Tom Jack is a Managing Director in the Real Estate Group, based in New York. Since joining Blackstone in 2017, Mr. Jack has been involved in analyzing real estate investments in several property sectors and has worked on a variety of transactions, including the acquisition AIG’s affordable housing assets, the Cornerstone affordable housing portfolio, Extended Stay America, and Great Wolf Resorts.

Before joining Blackstone, Mr. Jack was a Vice President at Colony Capital where he worked on a variety of real estate transactions across the United States. Mr. Jack began his career at Goldman, Sachs & Co. in the Real Estate, Gaming and Lodging investment banking group.

Mr. Jack received a BS from the McIntire School at the University of Virginia, where he graduated with distinction.

Tony LaBarbera

Co-Head of Americas Private Investments

Tony LaBarbera is a Managing Director and Co-Head of Americas Private Investments for Blackstone Real Estate Debt Strategies (“BREDS”), based in New York. Mr. LaBarbera is responsible for overseeing the Americas Private Investments team in sourcing, underwriting, negotiating and structuring senior loans, mezzanine loans, preferred equity and other debt investments across all asset types and geographies. Mr. LaBarbera previously worked for Blackstone in London on both the BREDS and Real Estate Capital Markets teams. Prior to joining Blackstone’s Real Estate group in 2014, Mr. LaBarbera was an analyst in Blackstone’s Advisory group with Park Hill Real Estate.

Mr. LaBarbera received a BS from the McIntire School of Commerce at the University of Virginia where he graduated with distinction.

Danny Malkin

Co-Head of Americas Private Investments

Danny Malkin is a Managing Director and Co-Head of Americas Private Investments for Blackstone Real Estate Debt Strategies (“BREDS”), based in New York. Mr. Malkin is responsible for overseeing the Americas Private Investments team in the sourcing, underwriting, and structuring of debt investments across all asset types and geographies. Mr. Malkin previously worked for Blackstone in both London and Sydney.

Mr. Malkin received a BBA from the Ross School of Business at the University of Michigan.

Dominik Palowski

Head of Asset Management Europe and Managing Director

Dominik Palowski is a Managing Director and Head of Asset Management Europe in Blackstone Real Estate Debt Strategies (“BREDS”), based in London. Since joining Blackstone in 2018, Mr. Palowski has been involved in originating, underwriting, structuring, and asset managing real estate debt investments across all asset types throughout Europe.

Prior to joining Blackstone, Mr. Palowski was in the U.S. Real Estate group at The Carlyle Group where he was involved with real estate equity investments across various sectors. Prior to that, Mr. Palowski was on the Real Estate Investment Management team at Starwood Hotels & Resorts.

Mr. Palowski received a BS from the McIntire School of Commerce at the University of Virginia and an MBA from London Business School.

Jonathan Roberts

Managing Director

Jonathan Roberts is a Managing Director in Blackstone Real Estate Debt Strategies (“BREDS”) on the Private Investments team, based in New York. Mr. Roberts is involved in sourcing, underwriting, and structuring a diverse array of real estate-related debt investments across public and private markets.

Since joining Blackstone in 2015, Mr. Roberts has focused on both Blackstone’s public and private real estate investment strategies.

Prior to joining Blackstone, Mr. Roberts started his career in the Real Estate Investing and Servicing business unit of Starwood Property Trust focused on high yield debt investing and special servicing.

Mr. Roberts holds a BS in Interdisciplinary Studies in Real Estate Finance from Cornell University.

J.T. Sizemore

Managing Director

J.T. Sizemore is a Managing Director in Blackstone Real Estate Debt Strategies (“BREDS”) on the Private Investments team, based in Los Angeles. Mr. Sizemore is involved in sourcing, underwriting, negotiating and structuring debt investments across all asset types and geographies with a focus on the office sector.

Prior to joining Blackstone in 2014, Mr. Sizemore worked in real estate private equity acquisitions roles with Morgan Stanley Real Estate Investing in San Francisco and DLJ Real Estate Capital Partners in Los Angeles. Mr. Sizemore also worked as a developer with The Kor Group and as a strategy consultant with Bain & Company.

Mr. Sizemore graduated summa cum laude with a BS in Industrial and Systems Engineering from the University of Southern California and received an MBA from Wharton, where he was a Palmer Scholar.

Stefano Tomaselli

Managing Director

Stefano Tomaselli is a Managing Director in Blackstone Real Estate Debt Strategies (“BREDS”) on the Private Investments team, based in London. Mr. Tomaselli focuses on sourcing, underwriting, negotiating, and structuring debt investments across all asset types throughout Europe.

Prior to joining Blackstone in 2021, Mr. Tomaselli was an Associate Director at M&G Investments in the real estate lending group, where he was involved in real estate debt investments throughout Europe.

Mr. Tomaselli received a BA with Honours from Durham University, and an MSc with Distinction from Bayes Business School.

Andrew Winchell

Managing Director

Andrew Winchell is a Managing Director in Blackstone Real Estate Debt Strategies (“BREDS”) on the Private Investments team, based in New York. Mr. Winchell is involved in the sourcing, underwriting, and structuring of debt investments with a focus on the data centers sector. Mr. Winchell has worked for both the BREDS and Real Estate Capital Markets teams in London and New York.

Prior to joining Blackstone in 2017, Mr. Winchell Worked at Fortress Investment Group as a Real Estate Investment Analyst.

Mr. Winchell received a BS in Mechanical Engineering from Bucknell University.

Board of Directors

Leonard Cotton

Lead Independent Director, Former Vice Chairman, Centerline Capital Group

Leonard W. Cotton has been a director since 2014. Mr. Cotton is the former vice chairman of Centerline Capital Group (a position he held from 2006 to 2008). He was also on the executive committee of the Commercial Real Estate Finance Council, or CREFC, from 2001 to 2010 and was president of CREFC from 2007 to 2008. Mr. Cotton previously served as chairman and chief executive officer of ARCap REIT (a position he held from 1995 to 2006), a real estate finance company acquired by Centerline Capital Group in 2006, and chairman and chief executive officer of ARCap REIT’s predecessor, REMICap. During his tenure at ARCap REIT, Mr. Cotton was instrumental in establishing ARCap REIT as a nationally recognized CMBS investor in subordinated bonds. From 1992 to 2002, Mr. Cotton was a president and partner in Harbour Realty Advisors, a real estate-related special situation investment and commercial property management company. Prior to joining Harbour Realty Advisors, Mr. Cotton was engaged in a number of real estate-related entrepreneurial endeavors, including acting as consultant on real estate workout strategies and the development of high-end residential properties. Mr. Cotton also serves on the board of trustees of Bowdoin College and Maine Public Broadcasting Network, a state network of public television and radio stations. He started his career in 1972 with Citibank, working in commercial real estate lending and workout business units. He also served as an independent director of FundCore Institutional Income Trust Inc., a public unlisted mortgage real estate investment trust (“REIT”), from 2010 to 2012 and is a former board member of the Real Estate Roundtable.

Mr. Cotton received an M.B.A. in Finance from Columbia University and a B.A. in American History from Bowdoin College.

Jean Hsu

Former Head of Private Debt, CalPERS

Jean Hsu has been a director since October 2025. Ms. Hsu is the former Head of Private Debt at California Public Employees’ Retirement System (CalPERS) and was a member of the Investment Office leadership team, until her retirement in 2024. At CalPERS, Ms. Hsu previously held several other senior roles, including Managing Investment Director and Head of Opportunistic Strategies, where she launched the commercial real estate lending portfolio. Earlier, as a Portfolio Manager for CalPERS’ Global Fixed Income strategy, she led CalPERS’ effort in participating in the Term Asset-Backed Securities Loan Facility (TALF) during the great financial crisis, and subsequently built the collateralized loan obligation (CLO) program. Ms. Hsu also serves as a member of the Board of Directors of Antares Private Credit Fund.

Ms. Hsu received a Bachelor of Laws from National Taiwan University and practiced law with a focus on banking, securities and corporate finance. She also holds a Master of Business Administration from the Wharton School at the University of Pennsylvania and is a Fulbright Scholar.

Nnenna Lynch

Founder & CEO, Xylem Projects

Nnenna Lynch has been a director since 2021 and is the chief executive officer of Xylem Projects LLC (“Xylem”), which she founded in July 2018. Xylem is a mission-driven real estate firm. Prior to founding Xylem, Ms. Lynch served as managing principal and head of development for The Georgetown Company, a real estate investment and development company, which she joined in March 2014. From 2008 to February 2014, she was a senior advisor on economic development for the Bloomberg mayoral administration in New York City. Prior to that role she was a partner at Urban Green Builders LLC and an analyst in fixed income derivatives at Goldman Sachs. Ms. Lynch has served as a member of the board of directors of AvalonBay Communities, Inc. (NYSE: AVB) since May 2021, where she is chair of the investment and finance committee, and she also serves on the board of Stake, a private financial technology company.

In addition, Ms. Lynch serves in leadership positions at non-profit organizations, including as chair of the board of directors of the New York Road Runners, a non-profit organization that organizes the New York City Marathon and other races, and as co-president of the Association of American Rhodes Scholars. Through the end of 2024, Ms. Lynch also served on the board of the Van Alen Institute, which focuses on helping create equitable cities through inclusive design, and on the board of trustees of Villanova University, where she served on the investment committee.

Ms. Lynch graduated summa cum laude from Villanova University, where she won five NCAA track titles and was elected Phi Beta Kappa. She also received a Master’s degree from University of Oxford, where she attended as a Rhodes Scholar

Michael Nash

Former Global Chairman of BREDS

Michael Nash is the Co-Founder and Former Chairman of Blackstone Real Estate Debt Strategies. Prior to his retirement from Blackstone, Mr. Nash was a member of the Real Estate Investment Committee for both Blackstone Real Estate Debt Strategies and Blackstone Real Estate Advisors, and he also previously served as Executive Chairman of Blackstone Mortgage Trust. Additionally, in 2021, Mr. Nash became Chairman of Blackstone’s GP Stakes business, focusing on the acquisition of minority ownership interests in private equity and other private-market alternative asset management firms.

Mr. Nash currently serves as a member of the board of directors of Hudson Pacific Properties, Inc. (NYSE: HPP) and a senior partner at Hunter Point Capital, an independent investment firm providing capital solutions and strategic support to alternative asset managers.

Prior to joining Blackstone, Mr. Nash was with Merrill Lynch from 1997 to 2007 where he led the firm’s Real Estate Principal Investment Group – Americas. Prior to 1997, Mr. Nash held various positions with Barclays Bank, Bank of Nova Scotia and Deloitte Haskins & Sells.

Mr. Nash received a B.S. in Accounting from State University of New York at Albany, as well as an M.B.A. in Finance from the Stern School of Business at New York University.

Henry N. Nassau

Partner, Dechert LLP

Henry N. Nassau has been a director since 2003. Mr. Nassau was the chief executive officer of Dechert LLP from July 2016 until July 2023. Mr. Nassau has been a partner at Dechert since September 2003 and was previously deputy chair of practice group management and the chair of the corporate and securities group for over ten years. Mr. Nassau was the chief operating officer of Internet Capital Group, Inc. (NASDAQ: ICGE), an Internet holding company, from December 2002 until June 2003, having previously served as managing director, general counsel and secretary since May 1999. Mr. Nassau was previously a partner at Dechert LLP from September 1987 to May 1999 and was chair of the firm’s business department from January 1998 to May 1999. At Dechert LLP, Mr. Nassau engages in the practice of corporate law, concentrating on mergers and acquisitions, public offerings, private equity and venture capital financing. Mr. Nassau is the manager of a variety of private entities engaged in investments focusing primarily on private and growth equity opportunities. He also serves on the advisory board of RAF Industries, Campus Apartments, TL Ventures and Graham Partners.

Gilda Perez-Alvarado

Group Chief Strategy Officer, Accor

Gilda Perez-Alvarado has been a director since February 2023 and is the Group Chief Strategy Officer at Accor, where she is responsible for overseeing global strategy, relations with hotel owners, and strategic partnerships. Based in Paris, Ms. Perez-Alvarado is also a member of Accor’s Management Board. Prior to joining Accor, Ms. Perez-Alvarado was the Global Chief Executive Officer of JLL Hotels & Hospitality Group, where she oversaw the group’s global investment sales, investment banking, advisory and tourism divisions, as well as ran the cross-border investment sales team. Ms. Perez-Alvarado previously worked in the Hospitality and Leisure advisory practice at PricewaterhouseCoopers.

Ms. Perez-Alvarado currently serves as a member of the Board of Trustees of Cornell University, IREFAC, WTTC, and the Cornell School of Hotel Administration Dean’s Advisory Board. Ms. Perez-Alvarado received a Bachelor of Science from the Cornell School of Hotel Administration, where she graduated with Honors. She received her Master’s in Business Administration from Instituto de Empresa (IE Business School) in Madrid.

Lynne B. Sagalyn

Earle W. Kazis and Benjamin Schore Professor Emerita of Real Estate and Director, Paul Milstein Center for Real Estate and the MBA Real Estate Program, Columbia Business School

Lynne B. Sagalyn has been a director since 1997. Dr. Sagalyn is the Earle W. Kazis and Benjamin Schore Professor Emerita of Real Estate at Columbia Business School where she taught for more than twenty years and was the founding director of the Paul Milstein Center for Real Estate and the MBA Real Estate Program. Previously, Dr. Sagalyn held appointments at the University of Pennsylvania in both the School of Design (City Planning Department) and the Wharton School (Real Estate Department) and at the Massachusetts Institute of Technology (Department of Urban Studies and Planning). Dr. Sagalyn served as a member of the Advisory Board of PRIME, a Morgan Stanley private equity fund, until 2022. She serves on the board and as vice chair of The Skyscraper Museum, and on the board of and as chair of the audit committee of the New York City Trust for Cultural Resources. From 2010 to 2018, Dr. Sagalyn was vice chairman of UDR, Inc. (NYSE: UDR), a self-administered REIT in the apartment communities sector, where she served as a director for 23 years until May 2019. She has also served on the New York City Board of Education Chancellor’s Commission on the Capital Plan.

Contacts

New York

345 Park Avenue

New York, NY 10154

Phone: +1 (212) 583-5000

ORIGINATION CONTACTS

Los Angeles

100 Wilshire Blvd, Suite 200

Santa Monica, CA 90401

Phone: +1 310 310 6949

ORIGINATION CONTACTS

London

40 Berkeley Square

London, W1J 5AL, U.K.

Phone: +44 (0)20 7451 4000